Why Freddie Mac SBL Beats the Pants Off Your Bank

As an entrepreneur who runs his own independent mortgage brokerage, I am always shocked at how few multifamily investors are aware that Freddie Mac SBL is even an option for multfamily loans between $1 million-$7.5 million. I’m not an overly pushy kind of broker, and I always tell my clients and prospects to “Do what works best for you.” but I just had to write this because I hear the same story almost everyday.

You finally found an apartment property to buy as an investment. You’ve done your research, crunched a few numbers and it seems like a good deal. You go to your bank to see what sort of loan you can get and you immediately hit a wall.

Your bank says something like- ‘Sorry, it’s out of our lending region.’ Or ‘You’ve already maxed out your borrowing limit.’ Or ‘You don’t show enough income on your tax returns.’ Or ‘Not all of your partners are US citizens.’

Or maybe you’ve been thinking about refinancing but you find out your bank limits loan proceeds on your refinance because of “banking regulations”. So now you can’t access the liquidity you’ve built up in your apartment property.

It’s bad news that we hear from folks every single day. Fortunately a few years ago Freddie Mac- yes, the “Government Sponsored Enterprise” – decided to make big waves in the very large pool of small balance loans for multifamily properties. And the banks have been on their heels ever since.

That’s because there are 3 KEY advantages that Freddie Mac SBL loans have that the banks just can’t touch, which is HUGE if you need a multifamily loan between $1,000,000 to $7,500,000.

#1 It’s a NON-RECOURSE LOAN

If you’re not familiar with the term you’ve been missing out. A FULL RECOURSE LOAN is what your bank is going to jam you into. That’s not a good thing. In fact it’s a BAD THING because ALL of your assets are potentially at risk in the event of a default.

A NON-RECOURSE LOAN limits the lender’s ability to be made whole strictly to the asset pledged as collateral… assuming there was no fraud, bankruptcy, unpaid taxes or other BAD BOY ACTS of course. So that’s important when you own multiple properties, a business, a home, and especially if you have other personal liabilities- like Doctors and high net worth individuals.

#2 FREDDIE MAC SBL IS JUST A BETTER LOAN

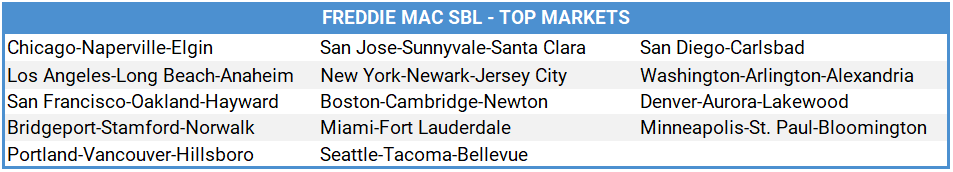

Let me count the ways it’s better than a bank loan! Freddie Mac SBL rates are BETTER than the bank rates and they’ll provide up to 80% LTV in top markets on 5, 7 and 10 yr loan terms. Oh, and there’s tons of options for prepayment penalties, interest only, and you can even rate lock at application.

Whereas your bank usually takes FOREVER to get you a term sheet, then they’ll need to put your tax returns under a microscope, and they may even change the deal before closing! That and they just have limited options outside of the standard 5 year, full recourse loan.

#3 IT’S EASY TO QUALIFY

A current rent roll and trailing 12-month (T12) income statement is usually enough to get an instant soft quote from us here at Rhenium Capital.

Basic borrower info (balance sheet and resume) along with the property info is enough to get an executable term sheet and Rhenium Capital can typically have that ready for you within 48 hrs.

There’s no need to show taxes or run your credit prior to closing. That’s because Freddie Mac SBL is a non-recourse lender- we went over this earlier- so all they require is that the borrower, as in you and whoever else has an interest in the property, have a minimum net worth equal or greater than the loan amount and combined liquidity of at least 9 months of principal and interest payments.

Freddie Mac SBL is a non-recourse, way-better-than-a-bank loan, that’s easy to qualify for! Oh and those “TOP MARKETS” that can get up to 80% LTV right now… there’s a chart right below.